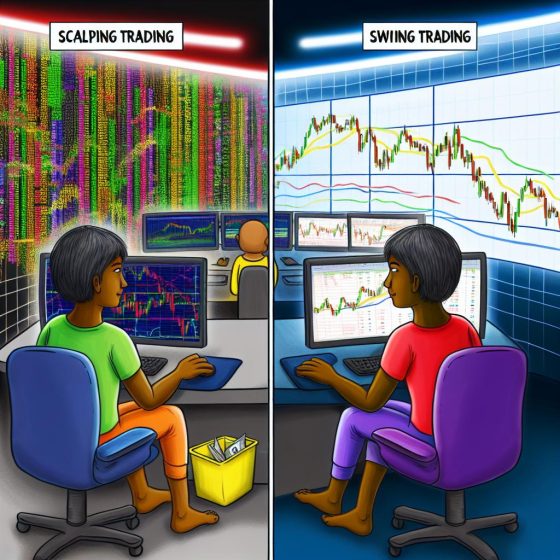

Understanding Scalping and Swing Trading

In the dynamic and fast-paced world of trading, strategies and methods vary widely based on individual preferences, objectives, and risk tolerance. Among the numerous strategies available, scalping and swing trading stand out as two popular approaches, each with its unique characteristics and challenges.

Scalping is a trading method focused on making numerous trades in a single day, capitalizing on small price changes in the market. Traders who employ this strategy hold positions for only moments, such as seconds or minutes. The essence of scalping hinges on exploiting small price fluctuations with large trade volumes, thereby accumulating incremental gains that contribute to profitability over time.

In contrast, swing trading focuses primarily on realizing short- to medium-term gains by holding positions over a more extended period, often ranging from several days to weeks. Swing traders aim to capitalize on predicted market movements, benefiting from larger price shifts over time. This strategic approach involves a deeper analysis and broader market trend evaluations compared to scalping.

Reasons for Transitioning from Scalping to Swing Trading

Traders might decide to shift from scalping to swing trading due to various rational considerations that often align with personal circumstances and trading environments.

Time Commitment and Flexibility

One of the primary factors influencing a trader’s decision to transition from scalping to swing trading is time commitment. Scalping demands intense focus, quick decision-making abilities, and substantial daily time investment. Scalpers need to remain continuously attentive to their screens to seize fleeting market opportunities. In contrast, swing trading provides greater flexibility and requires less time monitoring the markets. This increased flexibility makes swing trading an appealing choice for those balancing trading with other life commitments.

Transaction Costs Impact

Frequent trading, which is inherent in the scalping strategy, inevitably results in accumulating transaction costs, such as broker commissions and exchange fees. Over numerous trades, these costs can significantly reduce overall profits. On the other hand, swing trading involves executing fewer trades, which minimizes transaction costs and can enhance net profitability. This financial advantage is a key consideration for traders looking to maximize returns.

Psychological Stress

The fast-paced environment and rapid decisions inherent in scalping can exert significant mental pressure on traders. The demanding nature of constantly making high-stakes decisions can be intensely stressful. By contrast, swing trading tends to be less stressful because it does not require continuous market engagement throughout the day. The ability to step back and make more deliberative decisions reduces mental fatigue and improves overall trading experience.

Market Analysis Techniques

Scalping is profoundly reliant on technical analysis, focusing on identifying price patterns on charts and using technical indicators in minute graphs. While swing trading also employs technical analysis, it places a stronger emphasis on incorporating fundamental analysis. Swing traders develop a holistic view by analyzing broader economic, political, and industry factors that might influence market trends. Traders switching to swing trading gain the advantage of this broader perspective, enabling more balanced decision-making processes.

Profit and Loss Potential

Dealing with fluctuating profit potentials, traders in the scalping business often experience frequent smaller gains due to the short duration of their trades. Conversely, swing trading presents opportunities to capture more significant market movements. Although the number of trades is fewer, the profit potential per trade can be substantially larger, making swing trading appealing to those focused on substantial returns.

The Transition Process

The shift from scalping to swing trading entails numerous adjustments and learning opportunities. Traders need to become acquainted with different analytical tools that cater to the longer timeframes of swing trading. This includes revisiting their risk management strategies to suit the varied nature of swing trading. Furthermore, they must review and update their trading plans to adapt to the new timeframes and methods they will use in their trades.

Additionally, traders venturing into swing trading need to understand its broader analytical context and how it intertwines market factors beyond just the technical aspects. Focusing on developing a balanced trading strategy that accounts for both technical and fundamental elements is crucial to success in swing trading.

In Conclusion

In summary, transitioning from scalping to swing trading can offer traders greater flexibility and the potential for increased profitability. Reduced time commitments, minimized transaction costs, and the ability to capture larger market movements are enticing reasons for making this switch. By understanding the distinctions between these strategies and adapting their trading approaches accordingly, traders can expect to optimize their trading experience and better realize their financial objectives.

For those seeking to continue their educational journey in trading strategies, platforms such as Investopedia offer comprehensive resources and insights into the financial markets.