Understanding the Concept of Chasing Losses

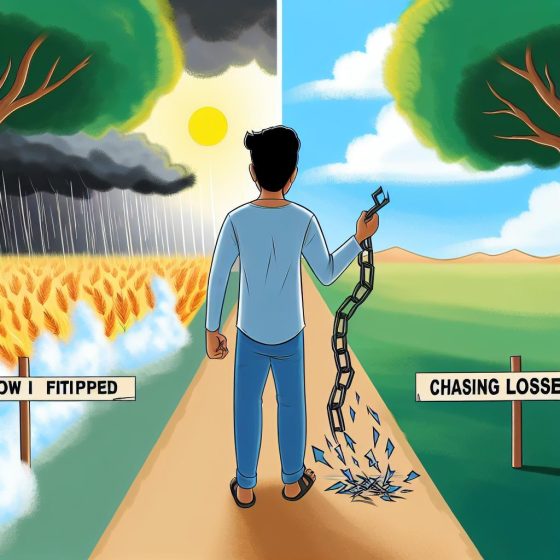

Chasing losses is an often observed behavior in both gambling and trading environments, characterized by individuals continuing to invest money with the hope of recovering prior losses. This pattern of behavior can rapidly escalate, resulting in more significant financial difficulties. Identifying and understanding this pattern marks the initial stage in the journey toward meaningful change.

Recognizing the Problem

One of the most critical steps is acknowledging when you are engaged in chasing losses. This involves recognizing that your investment approach is overly influenced by emotional impulses rather than being driven by rational and calculated strategies. The compulsion to recover lost money can lead to subpar decision-making and may propel individuals to engage in riskier bets or investments, which can further exacerbate financial losses.

Identifying Emotional Triggers

Emotional responses, such as frustration and desperation, commonly fuel the behavior of chasing losses. Identifying these emotional triggers is pivotal to gaining command over your actions and decisions. One helpful practice is maintaining a journal where you chronicle your emotions during trading sessions or after experiencing a financial loss. This can provide clarity on the patterns of your emotional triggers, thus aiding in their management.

Setting Realistic Goals

A fundamental step in overcoming the propensity to chase losses involves setting realistic and attainable goals. This requires the establishment of clear boundaries concerning how much risk you are prepared to undertake and ensuring these stipulated limits are respected and adhered to. By doing so, you cultivate a structured approach that can significantly reduce impulsive decision-making.

Creating a Strategic Plan

The formation of a strategic plan that is devoid of emotional influence is vital. Such a plan should be grounded in analytical evaluations and an extensive understanding of market trends and conditions. Making use of tools and resources that provide reliable data can aid in making informed decisions. Staying informed is crucial, as it can substantially diminish the likelihood of falling into the trap of chasing losses.

Implementing Preventative Measures

After you have identified the issue and crafted a strategic plan, the subsequent step involves putting measures in place to prevent falling back into the same patterns.

Maintaining Discipline

Discipline is foundational to successful trading and prevents the cycle of chasing losses. Maintaining discipline involves adhering to your pre-established limits and avoiding any deviation due to emotional reactions that may arise during trading or gambling activities.

Using Technology to Assist

A spectrum of software and applications is available to assist in monitoring your activities and flag potential deviations from your established plan. These technological tools can help ensure adherence to your limits and provide consistent reminders of your overarching strategic objectives.

Seeking Professional Advice

If you’re encountering difficulties in discontinuing the habit of chasing losses, reaching out to financial advisors or counselors is a valuable step. Professionals can offer a fresh perspective and propose strategies to regain control over your financial decision-making processes.

Lessons Learned

The cessation of chasing losses is not a process that occurs overnight. It demands a commitment to reflection and an active effort towards changing deeply ingrained behavior patterns.

Reflecting on Your Journey

Engaging in active reflection on your journey and the progress you have made can serve as a significant motivator to stay on the correct trajectory. Celebrate your small victories, and use setbacks as learning opportunities to identify areas that may require further improvement.

In conclusion, comprehending the psychological dynamics underlying the tendency to chase losses, alongside taking proactive steps to avert such pitfalls, can vastly enhance your financial wellbeing and foster a more disciplined approach to gambling or trading. For those seeking further reading on effective trading strategies, consulting reliable financial literature can be greatly beneficial. For a comprehensive range of resources, Investopedia offers numerous reliable references on the subject.