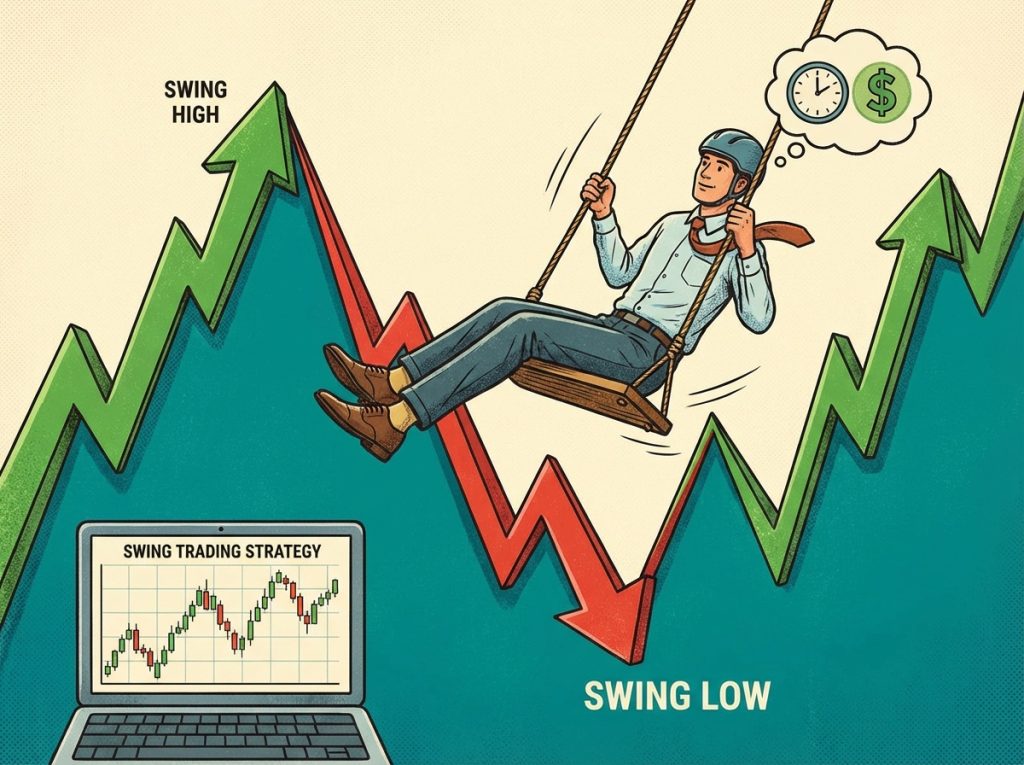

Swing trading on the FX market is a middle distance contest. It is neither the furious, millisecond world of scalping nor the slow, buy-and-hold patience of position investing.

Swing traders stay in their position as long as the underlying trend keeps going. The forex market: this can mean anything from a few hours to a few days or even a few weeks. Swing traders on other markets, such as the stock market, sometimes keep their positions open a lot longer,.

Swing traders tend to follow trends created by technical momentum or macro shifts. Trends can also be caused by market news.

The forex market is very attractive to swing traders since it’s a very liquid market and it’s possible to skillfully use stop-losses to almost guarantee that you sell near the top of a trend. This is achieved by consistently raising the stop loss as the underlying asset increases in price.

At the same time forex imposes specific frictions, overnight swaps, larger weekend gaps, and variable holiday rollovers, that change the math on any multi-day plan. This article lays out how to design, execute and manage a pragmatic swing program on forex, with attention to instrument choice, risk, execution, broker and operational hygiene you need to survive and scale.

This article focuses on swing trading on the forex market. It assumes that you have some basic knowledge about swing trading and how it works. If you do not know anything about swing trading then I recommend that you visit the website SwingTrrading.com before reading this article. Swingtrading.com is a website completely devoted to swing trading and it features a lot of information about how swing trading works and how to swing trade successfully.

Why choose forex for swing trading

Forex presents a set of practical advantages: very high liquidity in majors and many crosses, tight spreads during liquid hours which reduce entry and exit costs, 24 hour trading that lets you manage positions outside a single exchange’s hours, and available carry that can be a modest tailwind or a cost depending on funding rates. Those advantages make it easy to find multi-day trends and to scale position size without creating market impact. On the flip side, FX shows frequent regime shifts and abrupt price moves tied to macro events that create overnight gap risk. The overnight financing that leveraged CFD or margin accounts charge compounds with holding time and can turn otherwise attractive gross moves into net losses if you have not priced financing into your edge. Practical swing trading in FX therefore relies on a clear arithmetic of expected move versus cost per day, a disciplined stop regimen, and a preparedness to act ahead of scheduled macro events.

Timeframes and trade cadence

Define a strict horizon. Swing FX typically uses entry signals on daily or 4 hour charts and targets moves that last from several candles to a few weeks. Your time horizon should match signal persistence: if your entry signal is a breakout of a two-week consolidation you are implicitly planning to hold for a commensurate period; using that signal but exiting each day because of jitter defeats the purpose. A sensible cadence for many retail swing traders is to open no more than a handful of concurrent trades and to size each so that a single stop loss does not endanger mission-critical capital. Weekly planning and end of day checks are more relevant here than constant intraday fiddling; monitor positions around major sessions but avoid intraday noise that encourages overtrading.

Pair selection, liquidity and correlation

Pick the right pairs for the time horizon and size you intend to run. Majors such as EUR USD GBP USD USD JPY AUD USD typically deliver the best combination of tight spreads and deep liquidity which reduces slippage at both entry and exit. Exotic crosses and thinly traded pairs may offer larger nominal moves but will punish you with wider spreads, inconsistent fills, and large weekend gaps. Always account for correlation across pairs. Holding multiple longs in EUR related pairs or exposures across the same funding currency concentrates risk; construct the portfolio as a correlated book and not as independent bets. For swing trading it is often better to focus on a smaller universe of highly liquid pairs you understand well rather than to diversify into many low liquidity pairs that generate execution surprises.

Position sizing and risk management

Risk per trade must be expressed in absolute currency terms, not as an arbitrary percent of account that encourages oversized positions on small accounts. Convert stop distance into dollars at the intended lot size and ensure that the maximum loss per trade fits your pre-set risk tolerance. Many swing traders adopt a fixed dollar risk per trade or volatility adjusted sizing such as a fixed multiple of ATR so that position size scales sensibly with current market volatility. Maintain a simple portfolio level rule: maximum cumulative risk on open trades should be a fraction of account equity, and maintain a contingency buffer for margin calls. Use stops, not hope. If your stop is hit do not argue with the market; accept the loss as information and recalibrate.

Stop placement and exit planning

Stops must be both mechanically credible and market aware. A volatility-based stop using ATR multiples keeps you out of daily noise; structure-based stops placed behind recent swing highs or lows align the trade with price structure. Consider a two stage exit: a hard stop that protects capital and a trailing stop that locks profits as the move extends. Use limit orders for planned exits where practical to reduce slippage, but be aware limit orders can miss if the market gaps. For swing positions, set a maximum time stop as well — if a trade has not resolved in the expected window, either tighten the stop or close to free capital for better opportunities. Consistency beats cleverness: the most durable traders follow a simple stop and sizing rule consistently over time.

Overnight financing and carry effects

Financing costs are the structural drag on any multi-day leveraged FX trade. Brokers charge or pay a swap (roll) that depends on the interest rate differential between the currencies and the provider’s markup. For long holds these charges accumulate and reduce returns; for carry trades where you buy the higher yielding currency the swap can be a recurring gain. Always compute expected financing per day and compare it to expected daily move rates for your signal. Factor weekend roll rules and holiday adjustments into the expected holding cost. Some brokers also have asymmetric corporate or weekend funding rules that materially change carrying cost; read the fine print and test the math before committing to trades that rely on small expected price moves.

Execution quality and broker selection

Execution matters. For swing trading you do not need ultra-low latency infrastructure but you do need predictable fills, consistent spreads at the sizes you trade, reliable stop behaviour and transparent financing and corporate action handling.

Pick brokers that spell out exactly how they handle stop orders, especially when the market gets thin and prices jump around. Find out if they offer guaranteed stops, what you’ll pay for that, and how they figure out your financing charges. Stick with brokers who are regulated in places where client money protection actually means something—not just a sticker on their website.

Test with a small funded account: place representative entries and exits, record quoted spread and executed price, test overnight financing postings and request a small withdrawal. If the live behaviour systematically differs from demo, do not scale. The best broker for swing trading is one whose real world execution you have measured and validated, not the one with the flashiest app.

News, macro events and calendar hygiene

FX swings are often driven or amplified by macro events: central bank announcements, GDP prints, employment data and geopolitical headlines. For swing traders the practical choice is not to avoid news entirely but to have explicit rules about event windows. Many swing traders reduce size or tighten stops before scheduled major announcements and re-establish size after the dust settles. For trades initiated because of an anticipated event, use smaller position sizes and precise contingency plans because slippage and gaps are common. Maintain a calendar and treat it as part of the risk model; failing to plan for scheduled releases is a common cause of outsized single trade losses.

Backtesting, forward testing and demo/live calibration

Backtesting must include realistic friction: spreads at the sizes you intend to run, realistic slippage models, and the exact financing charges you will pay. Many backtests look attractive until realistic overnight fees and withdrawal realities are included. Forward test on a small live account to capture execution nuances such as partial fills and stop execution in thin hours. Demo accounts are useful for learning mechanics but notoriously optimistic about fills and latency. The correct sequence is: backtest conservatively, paper trade or demo to validate logic, then run a funded micro-test in production conditions and measure the realized edge before scaling.

Psychology and operational discipline

Swing trading requires a temperament that mixes patience with decisiveness. You must have the discipline to hold through logical intra-trade noise but the flexibility to accept that the market rarely cares about your story. Do not get angry when the trades do not go your way.

Keep a detailed trading journal that details both your emotions and technical aspects of your trades. Both aspects are important for your long-term success.

Scaling and portfolio construction

Scale by increasing size only after the strategy proves robust in live trading at smaller scale. Liquidity and execution are not linear: a trade that fills at micro lots may face additional slippage at larger sizes or trigger different routing behaviour from your broker.

Common mistakes to avoid

Do not ignore financing costs. Do not treat demo fills as equivalent to live fills. Do not overconcentrate in correlated pairs. Do not scale based on recent wins alone. Do not assume stops will execute at quoted prices during gaps. Do not use borrowed money you cannot replace quickly. Most of these errors are operational not theoretical; they are preventable by simple checks, funding discipline, and periodic live testing.

Practical checklist before you trade live

Ensure you understand the broker’s overnight financing formula and weekend roll rules; verify spread and stop execution at your intended size with a live micro account; build a simple position sizing rule that uses volatility adjusted stops; maintain an event calendar and explicit rules for holding through data; log and reconcile every trade including financing and corporate adjustments; keep a withdrawal test after initial profits so you know the cash-out mechanics work. These steps are not optional hygiene; they are the minimal operational controls that separate repeatable trading from speculation.